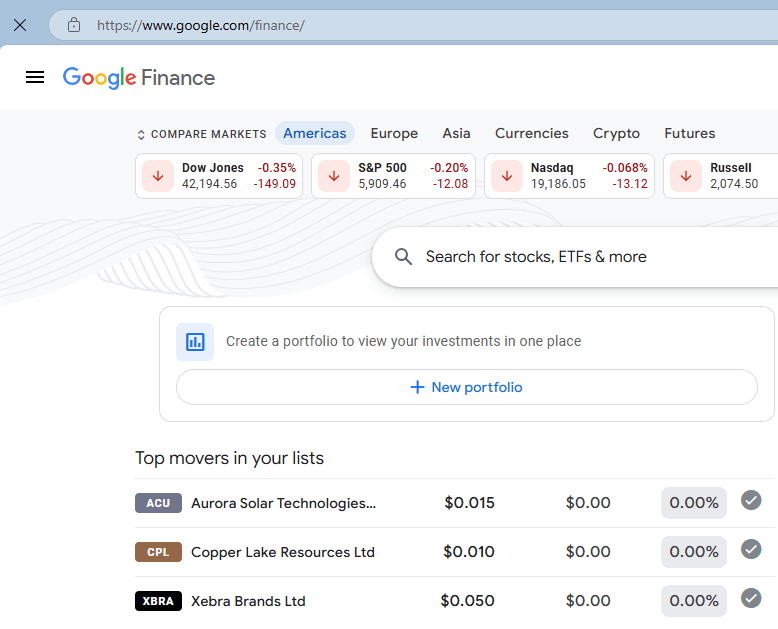

Have you heard of Google Finance 🙂 IT is a special area of google that tracks business performance through stock ticker prices. Arriving around 2005, I began establishing Google Portfolios and tracking stock performance and tracking charts. The site is located at Google Finance.

Once you go there you can search company news based on the algorithm that is there, or enter terms of your own and begin your own research. So to build on our last post, we learned that most active movers on the exchange are covered over at Stockhouse, so simply open a new tab in your browser and search the symbol or ticker that you are interested in. This way you can begin a daily tracker for stocks using Google Finance and cross-check it against Stockhouse and the CSE, or any other exchange to ensure good consistency and quality control.

Tracking stocks is fun, and depending on your risk tolerance, you may be interested in creating a portfolio at Google Finance.

You can easily compare markets, discover earnings news and important dates and create lists for easier task management and portfolio growth.

Click on a company and sometimes you will find quarterly earnings and other cool key metrics.

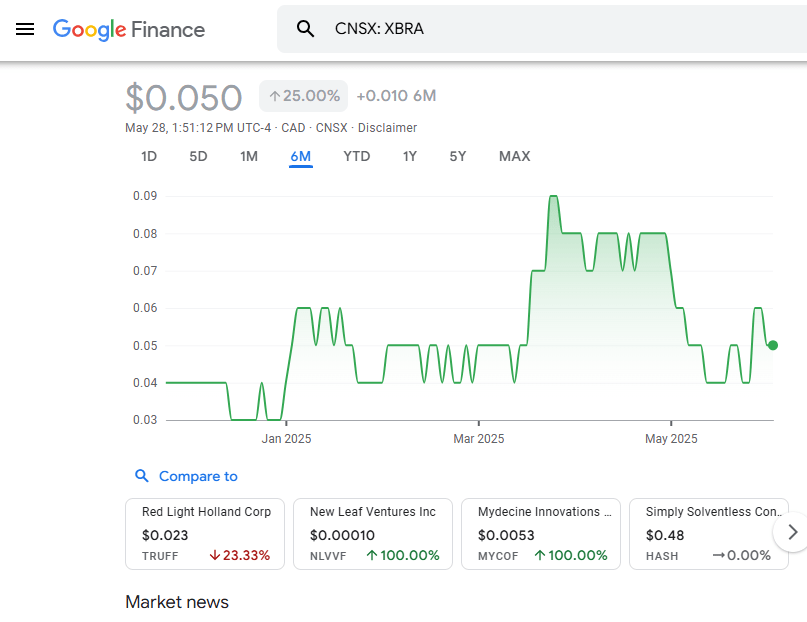

Having the temporal chart works wonders for this time series graph which can be adjusted across a series of date ranges. The cool thing about XBRA is that they have a license in Mexico that allows for seeding and cultivation of CBD, which they use as a commercial health product. It can be interesting to go to a companys webpage and learn more about their brand and what is new and relevant. A lot of times, a stock price will move on earnings calls and anticipated news, or other releases that ofter coincide with the momentum of the business.

Feel free to search any company on Google Finance including currencies, and even cryptocurrencies, or any other markets. Google uses a large quantum model of processing information, but also uses the same API to cover changes in the price of shares in real-time or slightly delayed.

As always, the more research we can gather on a subject can be important for us to build up a company profile and speculate about the prices that can be realized based on the real vs perceived price. The ask order, is the price sellers are asking for their units to be purchased at. The bid order, is the price buyers are asking to purchase the shares. The amounts on each side of the scale also indicate things like buy support and other strength indicators, such as how thin an order is, which can impact how fast or high the price can go; as well as the inverse.

Compounding all these results is good for the brain and practice for making trade decisions. Many times people will suffer a loss because of ill research. We all know the exciting part and the feeling of making money on the market, and that is why the research pays off. Choosing good resource sites to begin your explorations of stock markets, currencies, and the world of trading is a must for anyone planning to play these markets. When you discover your attitude and risk appetite you will be able to use your resource sites to discover companies and review them against each other to see where you get the best bang for your buck. So what are you waiting for, choose a platform and take control of your financial future through research and informed decisions. 🙂

Leave a comment